| Home > Technical Analysis Tutorial > Candlestick Patterns

|

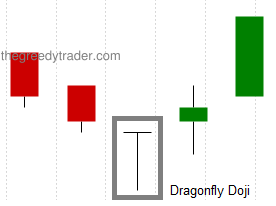

Bullish Dragonfly Doji

How to identify a Bullish Dragonfly Doji Candlestick Pattern

|

A Bullish Dragonfly Doji Pattern is one candle pattern that appears in a downtrend.

- The open, high, and close prices are equal or very close to each other.

- The candle has a long lower shadow.

|

Bullish Dragonfly Doji Candlestick Pattern Reliability

|

A Dragonfly Doji candlestick pattern is usually considered as a reversal candlestick pattern that appears in both uptrend and downtrend. According to our research, a Dragonfly Doji pattern appears more often in a downtrend and has an above average Gain/Loss ratio.

|

Daily Patterns |

Weekly Patterns |

| Frequency |

Above Average |

Low |

| Reversal in downtrend |

26% |

47% |

| Reversal in downtrend when parent trend is up |

39% |

90% |

| Reversal in downtrend when parent trend is down |

22% |

29% |

| Avg. Gain/Loss Ratio in Downtrend |

1.88 |

4.28 |

|

Market Sentiment

|

A long lower shadow indicates that a market sentiment sharply changed. A Dragonfly Doji pattern appears when a price moves significantly lower, but it can not hold. The low price attracts more buyers, and a market sentiment changes sharply from bearish to bullish.

|

Bullish Dragonfly Doji Trading Tips and Techniques

|

Usually bullish Dragonfly Doji traders wait for the next day bullish candle as a confirmation of the trend reversal before opening a new position. According to our research, a bullish next candle that closes above the Dragonfly Doji closing price increases the reliability of the reversal and increases the Gain/Loss Ratio for daily and weekly patterns. The next day gap up increases a pattern reliability and profitability, and it can be used as a reversal confirmation as well.

The following factors can improve a pattern reliability and profitability:

- Oversold momentum technical indicators.

- A price closer to the Lower Bollinger Band.

- A price is below 20, 50, and 100 Day Moving Averages.

- A bearish candle preceding a Dragonfly Doji for both daily and weekly patterns. The bigger is a real body of the preceding bearish candle the greater is the effect.

- A Doji candle gap down from the pervious candle close price.

- A longer Doji candle shadow.

|

Bullish Dragonfly Doji Examples

|

|

Example #1: Daily downtrend reversal signal

The following image shows a chart of The Williams Companies, Inc. (WMB) that formed a daily Bullish Dragonfly Doji pattern on May 16th, 2005 as a daily downtrend reversal signal.

| WMB: The Williams Companies, Inc.

|

|

|

|

The Candlestick/SAR technique generates the following trading signals:

May 16th, 2005:

- Buy on market open at $16.25.

- Set stop-loss at $15.62 (the pattern low).

|

June 21st, 2005:

- Sell at $19.15.

- Gain: 17.85% in 25 business days.

|

Example #3: Weekly downtrend reversal signal.

The following image shows a weekly Bullish Dragonfly Doji pattern that formed between May 3 and May 14, 2021 on a chart of Synopsys, Inc. (SNPS). The pattern signaled a weekly downtrend reversal and a beginning of a new weekly rising trend.

The Candlestick/SAR technique generated the following trading signals:

May 17, 2021:

- Buy on market open at $236.5.

- Set stop-loss at $225.02 (the pattern low).

|

September 22, 2021:

- Sell at $315.267.

- Gain: 33.3% in 90 business days.

|

|

|